By Jose Maria Macedo

Legendary investors and Nobel Prize winning economists such as Warren Buffett, Ray Dalio, Jamie Dimon, Robert Shiller and Joseph Stiglitz have all declared that cryptocurrencies are a bubble.

In this article I start describing what a bubble is and whether or not we’re in one. I then look at the possible effects of a bubble, using the 2000 dotcom bubble as a case study. Finally, I look at some of the strategies we can implement as cryptocurrency investors and long term holders in order to be prepared for any eventuality.

I won’t spend too long discussing whether or not we’re in a bubble (I don’t know nor do I think anyone can know) but rather examine the effects of a possible bubble on cryptocurrency believers and long term investors as well as what a rational response might be.

What is a bubble and are we in one?

A bubble occurs when an asset’s price exceeds its intrinsic value. While the word “bubble” sounds scary, almost all new technologies tend to go through one. Evidence shows that railways, radio and obviously the internet all underwent bubbles before they became mainstream. As Fred Wilson, founder of Union Square Ventures, tells us:

_“A friend of mine has a great line. He says ‘Nothing important has ever been built without irrational exuberance’. Meaning that you need some of this mania to cause investors to open up their pocketbooks and finance the building of the railroads or the automobile or aerospace industry or whatever. And in this case, much of the capital invested was lost, but also much of it was invested in a very high throughput backbone for the Internet, and lots of software that works, and databases and server structure. All that stuff has allowed what we have today, which has changed all our lives… that’s what all this speculative mania built.”_

Why do new technologies tend to bubble up? Because it’s very hard to value a new technology’s intrinsic value using traditional valuation methods (present value of discounted future cashflows) as they generally don’t generate any cashflows until very far into the future. In the case of blockchain technology this becomes even more difficult as many of them will never generate cashflows and yet will nevertheless be incredibly valuable.

With no cashflows in sight to ground people’s excitement, hype and FOMO reign supreme as people begin to speculate on all the possible industries the new technology could supplant (i.e. “decentralize everything”) with little regard for feasibility and time scales of how long this could take to come to fruition. Thus, the price increases and the “social contagion” effect described by Schiller begins to take place:

“News of price increase enriches the early investors, creating word-of-mouth stories about their successes, which stir envy and interest. The excitement then lures more and more people into the market, which causes prices to increase further, attracting yet more people and fueling “new era” stories, and so on, in successive feedback loops as the bubble grows.”

So are cryptocurrencies in a bubble? The reality is it’s impossible to say for sure because it’s extremely difficult to accurately calculate the intrinsic value of the technology. However, there are definitely some warnings signs to watch out for. As John Rothschild wrote in 1996:

“Joe Kennedy, a famous rich guy in his day, exited the stock market in timely fashion after a shoeshine boy gave him some stick tips. He figured that when the shoeshine boys have tips, the market is too popular for its own good.”

Looking on the news or browsing through Facebook will reveal a similar trend: cryptocurrency investing is hot right now and just about everyone (including Paris Hilton) seems to be getting in on it.

On the positive side, even if we are in a bubble, the 2000 dotcom bubble was primarily a North-American phenomenon and yet reached $3–5 trillion in size 17 years ago. Cryptocurrencies are a global phenomenon and yet are currently only worth $300 billion — meaning the bubble has a lot of room left to inflate.

Hodling through a bubble — a comparison with the 2000 dotcom bubble

There seems to be an underlying belief (faith?) among crypto investors that even if there is a bubble and this bubble pops, this won’t affect long term hodlers as the crypto market will always recover and reach new heights in the long-term.

Don’t get me wrong, a bubble bursting doesn’t necessarily matter if you’re a disciplined hodler and the asset you’re hodling has real underlying value and long term potential. Historically, most markets have recovered from these kinds of crashes and topped the peak bubble values eventually. However, if you buy at the wrong price, eventually may turn out to be a hell of a long time. For reference, here are some stats from the 2000 dotcom bubble.

The tech market took 17 years to get back to the values it was at during the 2000 tech bubble. Looking at specific companies shows a similar story. Microsoft stock price was $59/share at the peak of the tech bubble in 2000. It only surpassed this again at the end of October 2016. If you’d bought in mid 1999 (which was nowhere near peak bubble values in early to mid 2000) and decided to HODL, you’d have had to wait until August 2014 to break-even.

CISCO was priced at $79/share at the peak of the tech bubble. After crashing to $11 in 2002, it’s now worth $32 — less than half of what it was worth at the peak of the dotcom bubble. If you’d bought in mid 1999 you’d still be waiting to break-even.

Similarly, Intel shares were worth $73.94 at the peak of the tech bubble and 17 years later are worth $35.09, less than half of peak bubble valuation. If you’d bought in mid 1999, you’d have to wait until May 2014 to break-even.

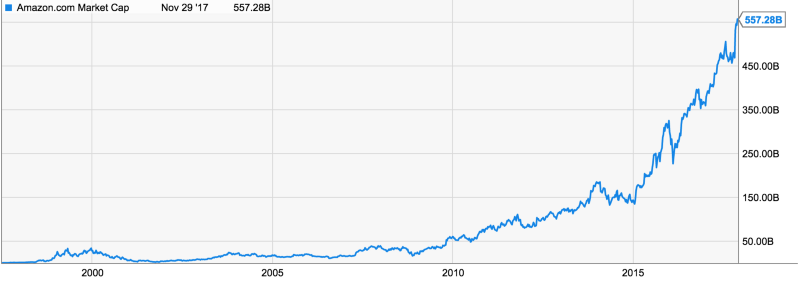

Even Amazon, the most successful dot-com era company by a mile only recovered its peak bubble valuation 7 years later in July 2007.

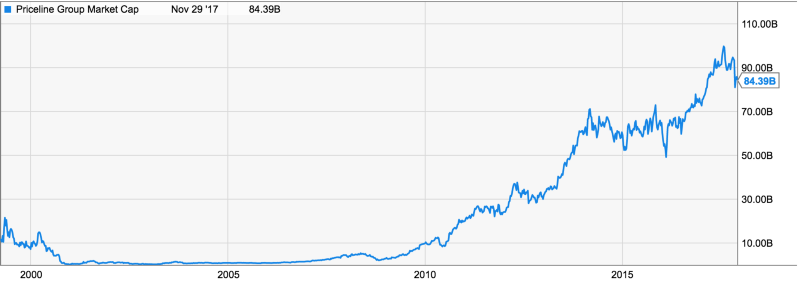

Other notable companies that survived the dotcom bubble like Intuit, Priceline, Adobe and also took 10+ years to regain their peak bubble valuations (although like Amazon, they’ve since gone on to grow way past it).

The point of this analysis isn’t to scare you, but rather to show that no matter how valuable the asset you’re buying, we must always remain mindful of price as there is such a thing as paying too high a price. Despite the fact that all the companies on this list were at the time and have been since incredibly valuable companies who’ve seen great success, they’ve really struggled to regain their prior valuations. Indeed, even if you manage to pick the Amazon of cryptocurrencies (a lot easier in hindsight than in real time as evidenced by this video of what people were saying about Amazon in 1999), if you buy at the wrong time you might still be waiting 7 years to break-even. Bear in mind, this analysis doesn’t even include the vast majority of dotcom companies which just failed outright.

What to do?

Given that there is evidence we’re in a bubble, and that it’s virtually impossible to time a bubble bursting, it seems wise to prepare ourselves. So what can we do? As a former professional poker player I like to think of things in terms of expected value or EV. EV is simply the sum of all possible values for a random variable, each value multiplied by its probability of occurrence (if you don’t know what EV is I recommend you give this a read, it’ll change your life). We can use EV to calculate the most profitable option in any given scenario. Sound complicated? Let’s lay out some numbers to make sense of it.

Let’s say you’ve got $10,000 to invest and you think there’s an 80% chance of that we’re in a bubble and that when it pops you estimate it will wipe out 75% of crypto’s market cap. However, you don’t know when the bubble will pop, it could be 2 months or 2 years, and you estimate that staying out of the market will cost you 2x gains in the meantime. Furthermore, if the bubble does pop you believe the market will recover to reach its previous value over the next 5 years. If the bubble doesn’t pop, the market will keep on growing to 4x over the same time period. For simplicity’s sake let’s say the crypto market consists only of bitcoin which is initially worth $10,000 per coin.

In this case:

- If you stay out of the crypto market altogether you simply keep your $10,000. EV=$10,000

- If you invest all $10,000: If the bubble pops (80% chance), you will have made $20,000 but lose 75% of it when the bubble pops, ending up with only $5,000 which will go back to being worth $20,000 after 5 years. If the bubble doesn’t pop (20% chance), you will have made $40,000 over the same time period. EV = 0.8$20,000+0.2$40,000 = $24,000

- If you stay out initially with the aim of investing $10,000 once the bubble pops: If the bubble pops (80% chance), you could then invest $10,000 once the bubble pops and have $40,000 after 5 years. If the bubble doesn’t pop (20% chance), then bitcoin will be worth $40,000 and you lose $40,000 in opportunity cost. EV = 0.840,000 + 0.2-40,000 = $24,000

- If you invest $2,000 and keep $8,000 for when the bubble pops: If the bubble pops (80% chance) you’ll end up with $1000 of your initial investment and then you’ll put in $8,000. After 5 years, the $1,000 will end up being worth $4,000 and the $8,000 will be worth $32,000. If the market doesn’t crash (20% chance) you’ll have made $8,000. EV = 0.836,000 + 0.28,000 = $30,400.

Conclusion

It’s obviously a simplified model and you can play around with the numbers and get marginally different results, but the key insight is that even if you’re a fervent crypto believer, if you think there is a nonzero chance a crash might happen then in order to maximize your expected value (i.e. make the most money) you should keep some % of your money on the sidelines to invest once the bubble pops and lower your average buy-in cost. The higher the probability you assign to a crash, the more money you should keep on the sidelines and vice versa.

Thanks very much for reading. Depending on feedback I’ll be writing more of these so please let me know what you think either in comments or direct message!