by Steve

Why you should focus on vision, value, risk, and precedent when making your product

A few weeks ago, the Product Developer John Cutler published an excellent post called 40 Product Roadmap Questions to ask.

You should check it out. And read on.

As an Agile Coach, I frequently train Product Owners away from their traditional behaviours and I took a keen interest in the list of questions because it was not theoretical.

It was a legitimate tool to drive hard but valuable product conversations. The more I studied it, the more I could see a few patterns forming; every question could be distilled into one of four categories.

- Vision: The faculty of being able to see; to think or plan about the future with imagination

- Risk: Exposed to harm or loss

- Precedent: An earlier event that is regarded as an example or guide to be considered in subsequent similar circumstances.

- Value: Estimate the worth of

By categorising your questions we can deduce a lot about you product.

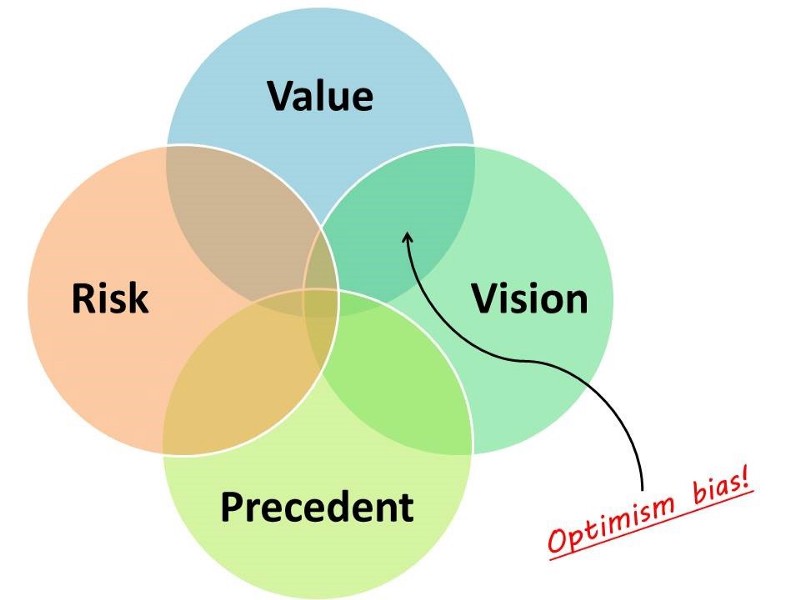

Most of your questions about Precedent & Vision have been answered

This most commonly occurs when an entrepreneur or a product owner has a track record of success and has just been struck with a bolt of inspired lightning, or, more dangerously, is reacting emotionally to market events.

This product often uses hope as a tactic and is not supported by a strong risk management profile or a value proposition. The product or service will throw large amounts of investment into marketing to try and justify the Vision as unique.

Any challenges will be waved away as not understanding the founder’s dream or not thinking far enough forward. A benefits case will often be hugely ambitious referencing large swathes of the market currently under-served. It is likely, the product will refer to a market that doesn’t even exist at present. It is highly unlikely to pass due diligence but will rest on the charisma of the Product Owner.

Examples

- Of course the music streaming service Tidal will be a success, Spotify is doing well and everything Jay Z touches is gold!

- Theranos was best known for its false claims to have devised revolutionary blood tests that used very small amounts of blood.

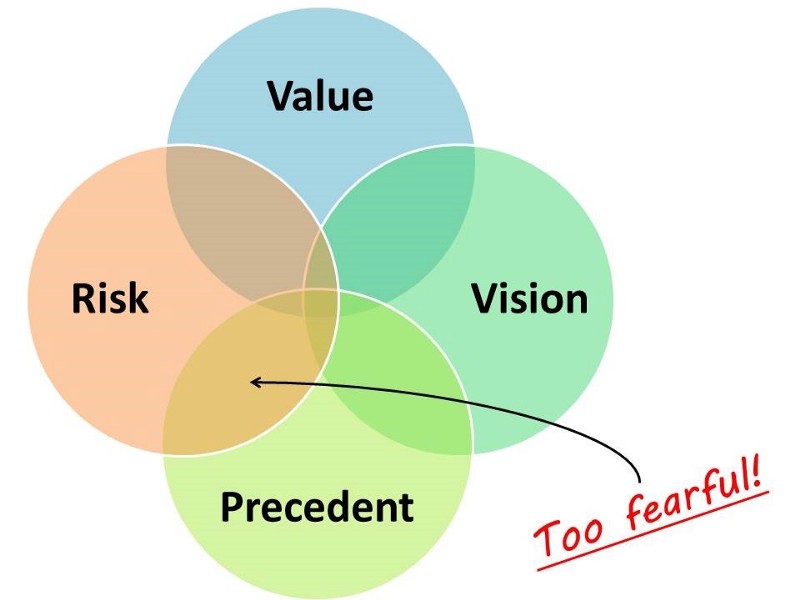

Most of your questions about Risks and Precedent have been answered

This type of product demonstrates a tentative approach by the Product Owner. It could be that within a startup the company is bootstrapping or a consultancy is seeking to build a relationship with a client. It is best described as softly softly catchee monkey where a team progress towards a goal using the proven route. This worked in the past, we completely understand the risks, let’s not deviate too much from the norm.

The danger with a Risk-Precedent model is that you produce Microsoft Word 2007followed by Microsoft Word 2010. If you are not the market incumbent then it can be very hard to displace the current champion with a strategy based on Risk management and Precedent. In the words of Walter Gretzsky to his son; don’t skate to where the puck is, skate where the puck is going to be.

In European football we prize forwards who can predict the flow of play and make space for themselves to capitalise on opportunities. We expect a certain level of confidence and prescience in the player to predict the future and move to meet it.

The team at Ia Writer had to trust in their Vision that the additional toggles and features of a typewriter program did not offer additional Value. They broke precedent to capitalise on a new market sector; minimalist writing apps and distraction-free productivity.

Example

- You know what is better than CCleaner 2.31? CCleaner 2.32!

Most of your questions Value and Vision have been answered

This type of product has a strong vision and value profile which generates confidence. The cliche hallmark is a young teenage/hacker who can see the future and is frantically coding towards that goal.

The Zuckerberg Effect. Or, for those older, the Tom from Myspace effect. Or for those even older, the Bill Gates effect. Or, the Alexander Hamilton effect since he was only 21 when he signed the Declaration of Independence. True story.

This sounds fantastic! What are the drawbacks I hear you say?

Ultimately, we cannot avoid the grown-up activities of good risk management and due diligence. Every project management framework encourages the team to review past projects to give the team the greatest chance of success.

Attempts to de-risk can seem stifling to a product team excited by a Vision and supported by a Value statement but hubris can have terrible side-effects. In military intelligence we counter this negative approach by using the 7 Questions Combat Estimate. The first question is always

What is the enemy doing and why?

The reason we prioritise this question first is because the other 6 questions are about our Vision and the Value of the operation, they are plans; but none of that will be important if the enemy completely counter our actions or surprise us. We risk manage before we execute.

Risk Management is the mark of a mature Product Team who have moved beyond wantrepreneurism.

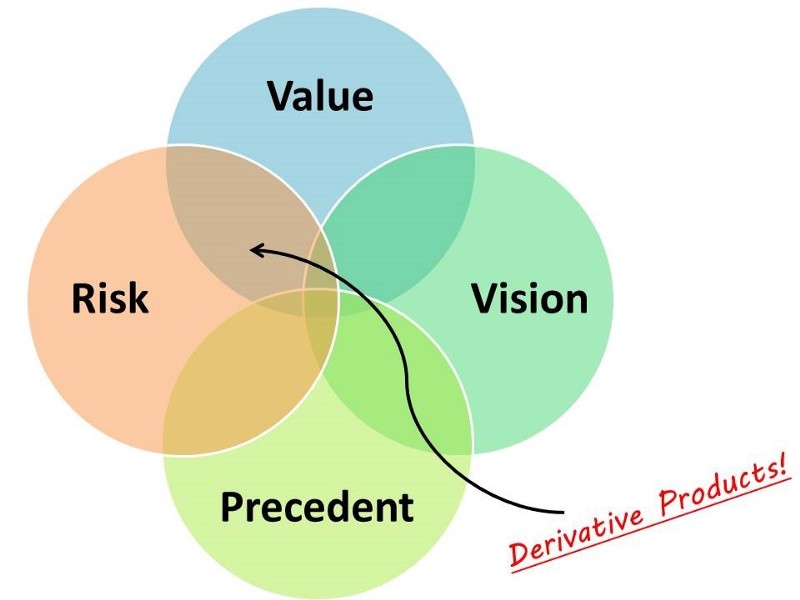

Most of your questions about Risk and Value have been answered

This situation arises when a company is producing derivative products; they use lagging indicators from the market and quantitative data to drive product decisions. Pepsi Max was a success so we will develop Coca Cola Zero. The product is characterised by a lack of a Vision or strong original concept.

The team without a Vision that can talk authoritatively about Value and have an excellent risk management strategy are producing a derivative product.

There is no shame in that. Maybe they are bringing a product to a new geographic market. Or they have cloned a competitor product.

There was a point in my first startup, Wallept, when we were pitching investors after a successful run in the European accelerator Startup Bootcamp. The founder and lead developer proudly stood on stage and displayed a gorgeous electronic loyalty application. It let you ditch loyalty cards in your wallet for a single application.

The VC’s blinked. Then one raised his hand.

There are 500 startups around the world doing the exact same thing…

30 of them in London alone.

How do I invest in you guys?

We didn’t have an answer. There wasn’t one. We were a derived product with no unique IP, no rock star coding team, no track record of success and no flourishing customer list. Our product was based on the Value of the market and even our risk management profile was weak.

We knew, deep down, Wallept was finished in the European and U.S markets.

The risk with a derived product is that sometimes the boat has sailed. Not every market has second mover advantage. Manifest destiny only worked for people who set off prior to 1850. After 1900 the winners were decided, everything after that was an inheritance game.

This is all awesome Steve, but what do I do in real life?

If you can go through the 40 Questions supplied above and honestly evaluate your product for Value, Risk, Precedent and Vision then you will have a much greater chance of success whether you are launching from within a startup or within a billion dollar enterprise company.